Statistiques de base

| Propriétaires institutionnels | 72 total, 67 long only, 0 short only, 5 long/short - change of 10,96% MRQ |

| Allocation moyenne du portefeuille | 0.3765 % - change of 6,20% MRQ |

| Actions institutionnelles (Long) | 8 732 934 (ex 13D/G) - change of 1,93MM shares 7,18% MRQ |

| Valeur institutionnelle (Long) | $ 44 769 USD ($1000) |

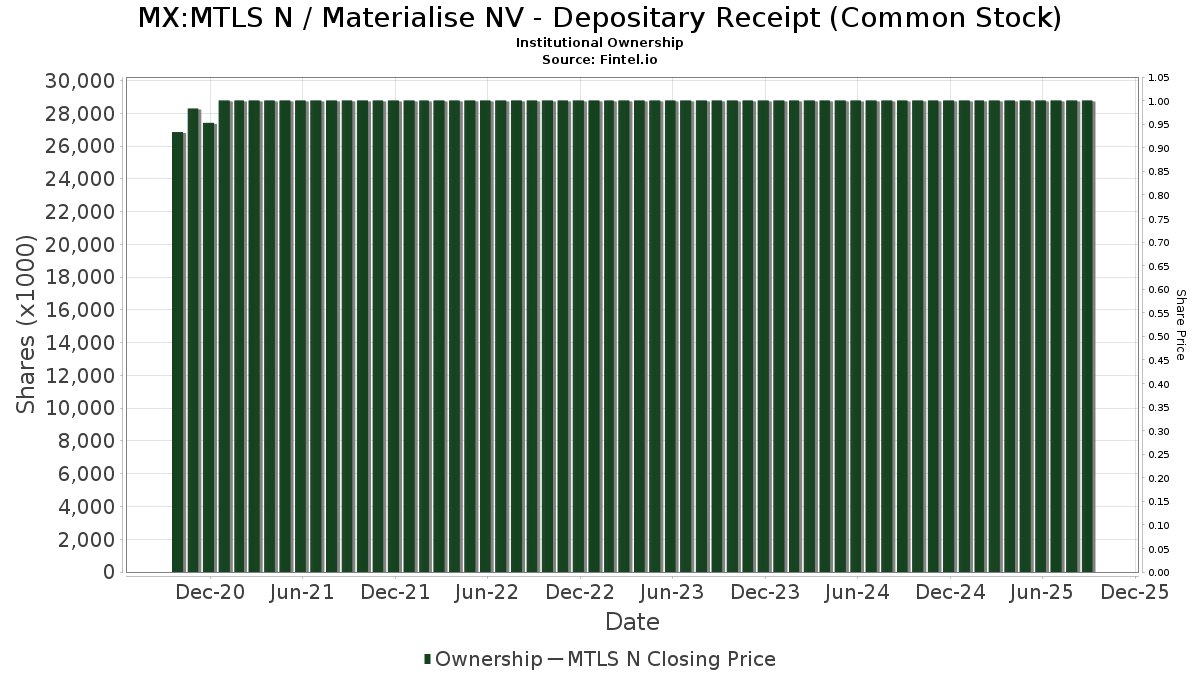

Participation institutionnels et actionnaires

Materialise NV - Depositary Receipt (Common Stock) (MX:MTLS N) détient 72 des propriétaires institutionnels et des actionnaires qui ont déposé des formulaires 13D/G ou 13F auprès de la Securities Exchange Commission (SEC). Ces institutions détiennent un total de 8,732,934 actions. Les principaux actionnaires incluent Disciplined Growth Investors Inc /mn, Rock Point Advisors, LLC, PRNT - The 3D Printing ETF, King Luther Capital Management Corp, ARK Investment Management LLC, Acadian Asset Management Llc, Arrowstreet Capital, Limited Partnership, Wells Fargo & Company/mn, Renaissance Technologies Llc, and Renaissance Group Llc .

Materialise NV - Depositary Receipt (Common Stock) (BMV:MTLS N) la structure de l'actionnariat institutionnel indique les positions actuelles des institutions et des fonds dans l'entreprise, ainsi que les derniers changements dans le volume des positions. Les principaux actionnaires peuvent être des investisseurs individuels, des fonds communs de placement, des fonds spéculatifs ou des institutions. L'annexe 13D indique que l'investisseur détient (ou a détenu) plus de 5 % de l'entreprise et qu'il a l'intention (ou a eu l'intention) de poursuivre activement un changement de stratégie commerciale. L'annexe 13G indique un investissement passif de plus de 5 %.

Indice de confiance des fonds

L'indice de confiance des fonds (anciennement score d'accumulation de participation) trouve les actions qui sont les plus achetées par les fonds. Il est le résultat d'un modèle quantitatif sophistiqué à plusieurs facteurs qui identifie les entreprises avec les niveaux les plus élevés d'accumulation institutionnelle. Le modèle de notation utilise une combinaison de l'augmentation totale des propriétaires déclarés, des variations des allocations de portefeuille chez ces propriétaires et d'autres indicateurs. Le chiffre varie de 0 à 100, les chiffres plus élevés indiquant un niveau d'accumulation plus élevé par rapport aux autres entreprises, 50 étant la moyenne.

Fréquence de mise à jour : Quotidienne

Déclarations 13F et NPORT

Les détails des déclarations 13F sont gratuits. Les détails des déclarations NP nécessitent une adhésion premium. Les lignes vertes indiquent de nouvelles positions. Les lignes rouges indiquent des positions clôturées. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau

pour débloquer des données premium et les exporter vers Excel ![]() .

.

| Date de dépôt | Source | Investisseur | Type | Prix moyen (Est) |

Actions | Δ Actions (%) |

Valeur déclarée (1000 $) |

Δ Valeur (%) |

Allocation de portefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 34 | 0 | ||||||

| 2025-04-10 | 13F | Retireful, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-05-14 | 13F | Smartleaf Asset Management LLC | 0 | -100,00 | 0 | |||||

| 2025-05-15 | 13F | Cubist Systematic Strategies, LLC | 0 | -100,00 | 0 | |||||

| 2025-05-01 | 13F | Ballentine Partners, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-05-15 | 13F | Aperture Investors, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-28 | NP | MAKX - ProShares S&P Kensho Smart Factories ETF | 3 235 | 170,03 | 17 | 112,50 | ||||

| 2025-07-16 | 13F | Randolph Co Inc | 0 | -100,00 | 0 | |||||

| 2025-08-07 | 13F | King Luther Capital Management Corp | 580 000 | 19,59 | 3 277 | 37,34 | ||||

| 2025-08-08 | 13F | Geode Capital Management, Llc | 17 527 | 0,00 | 99 | 15,12 | ||||

| 2025-07-30 | NP | APIE - ActivePassive International Equity ETF | 53 518 | -13,25 | 288 | -11,11 | ||||

| 2025-05-14 | 13F | Trexquant Investment LP | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Rhumbline Advisers | 5 103 | 5,63 | 29 | 21,74 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 49 | 81,48 | 0 | |||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 60 | 0,00 | 0 | |||||

| 2025-05-14 | 13F | Credit Agricole S A | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-16 | 13F | Signaturefd, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | BlackRock, Inc. | 5 575 | -61,09 | 31 | -55,71 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 77 714 | -3,92 | 439 | 10,58 | ||||

| 2025-08-15 | 13F | State of Tennessee, Treasury Department | 12 995 | 0,00 | 73 | 15,87 | ||||

| 2025-08-14 | 13F | Axa S.a. | 126 066 | 0,00 | 712 | 14,84 | ||||

| 2025-08-15 | 13F | WealthCollab, LLC | 843 | 0,00 | 5 | 0,00 | ||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 4 231 | -48,38 | 24 | -42,50 | ||||

| 2025-07-22 | 13F | Gsa Capital Partners Llp | 24 890 | -74,87 | 0 | |||||

| 2025-08-07 | 13F | Acadian Asset Management Llc | 502 640 | -2,93 | 3 | 0,00 | ||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Call | 30 700 | -10,23 | 173 | 2,98 | |||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 54 | -65,82 | 0 | |||||

| 2025-08-14 | 13F | Group One Trading, L.p. | 28 993 | -46,09 | 164 | -38,26 | ||||

| 2025-08-14 | 13F | Rock Point Advisors, LLC | 981 515 | 9,28 | 5 546 | 25,51 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Put | 48 500 | 80,97 | 274 | 109,16 | |||

| 2025-08-13 | 13F | Arrowstreet Capital, Limited Partnership | 467 276 | 15,15 | 2 640 | 32,26 | ||||

| 2025-08-13 | 13F | Walleye Trading LLC | Call | 0 | -100,00 | 0 | ||||

| 2025-08-13 | 13F | Walleye Trading LLC | Put | 0 | -100,00 | 0 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 12 654 | 71 | ||||||

| 2025-08-28 | NP | SEEIX - Sit International Equity Fund - Class I | 6 532 | 37 | ||||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 11 650 | 1 453,33 | 66 | 2 066,67 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 49 | 0,00 | 0 | |||||

| 2025-08-12 | 13F | LPL Financial LLC | 58 259 | 79,30 | 329 | 106,92 | ||||

| 2025-08-13 | 13F | Barclays Plc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | State Street Corp | 26 066 | -0,37 | 147 | 14,84 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 13 031 | 19 063,24 | 74 | |||||

| 2025-07-25 | 13F | Cwm, Llc | 150 | 0,00 | 0 | |||||

| 2025-05-12 | 13F | EAM Global Investors LLC | 0 | -100,00 | 0 | |||||

| 2025-05-14 | 13F | Walleye Trading LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 44 915 | -21,98 | 254 | -10,60 | ||||

| 2025-08-13 | 13F | Archon Capital Management LLC | 67 583 | 382 | ||||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 207 382 | -13,62 | 1 172 | -0,85 | ||||

| 2025-03-25 | NP | EAISX - Parametric International Equity Fund Investor Class | 9 400 | -38,56 | 79 | -13,33 | ||||

| 2025-08-08 | 13F | KBC Group NV | 212 932 | -0,68 | 1 | 0,00 | ||||

| 2025-08-28 | NP | SPDW - SPDR(R) Portfolio Developed World ex-US ETF | 8 595 | 2,11 | 49 | 17,07 | ||||

| 2025-05-15 | 13F | Millennium Management Llc | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 25 900 | 146 | |||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 96 400 | -66,86 | 545 | -61,98 | |||

| 2025-08-14 | 13F | Two Sigma Advisers, Lp | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 67 084 | 103,42 | 379 | 133,95 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 74 500 | 5,97 | 421 | 21,74 | |||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 19 700 | -67,33 | 111 | -62,50 | |||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 314 300 | 0,06 | 1 776 | 14,89 | ||||

| 2025-07-25 | 13F | Meritage Portfolio Management | 81 221 | 459 | ||||||

| 2025-08-14 | 13F | Bnp Paribas | 375 | 2 | ||||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 149 783 | 7,44 | 846 | 23,50 | ||||

| 2025-08-06 | 13F | Baillie Gifford & Co | 0 | -100,00 | 0 | |||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 130 | 0,00 | 1 | |||||

| 2025-04-21 | 13F | Ronald Blue Trust, Inc. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-08 | 13F | Quintet Private Bank (Europe) S.A. | 1 700 | 0,00 | 10 | 12,50 | ||||

| 2025-04-22 | NP | GINN - Goldman Sachs Innovate Equity ETF | 9 868 | 52 | ||||||

| 2025-08-28 | NP | NDOW - Anydrus Advantage ETF | 8 820 | 18,29 | 50 | 36,11 | ||||

| 2025-06-26 | NP | OWSMX - Old Westbury Small & Mid Cap Strategies Fund | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-06-27 | NP | HAOSX - Harbor Overseas Fund Institutional Class | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-04-29 | 13F | Truist Financial Corp | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | UBS Group AG | 117 014 | -22,99 | 661 | -11,51 | ||||

| 2025-05-09 | 13F | Deutsche Bank Ag\ | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-24 | NP | FNCMX - Fidelity Nasdaq Composite Index Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 17 527 | 0,00 | 94 | 2,17 | ||||

| 2025-06-25 | NP | PRNT - The 3D Printing ETF | 615 580 | 28,92 | 3 164 | -20,92 | ||||

| 2025-08-14 | 13F | Disciplined Growth Investors Inc /mn | 1 890 920 | 0,83 | 10 684 | 15,79 | ||||

| 2025-08-13 | 13F | New York State Common Retirement Fund | 14 764 | 0,00 | 0 | |||||

| 2025-05-13 | 13F | Sei Investments Co | 25 670 | 0,00 | 181 | 0,00 | ||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-05-14 | 13F | Peak6 Llc | Call | 0 | -100,00 | 0 | ||||

| 2025-08-14 | 13F | Fmr Llc | 6 673 | 0,00 | 38 | 15,63 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Put | 600 | -97,63 | 0 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Call | 34 000 | -3,13 | 0 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 0 | -100,00 | 0 | |||||

| 2025-06-03 | 13F | CWM Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Walleye Capital LLC | 26 609 | 150 | ||||||

| 2025-08-12 | 13F | Pathstone Holdings, LLC | 0 | -100,00 | 0 | |||||

| 2025-05-14 | 13F | Jump Financial, LLC | 0 | -100,00 | 0 | |||||

| 2025-05-09 | 13F | R Squared Ltd | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-01 | 13F | Logan Capital Management Inc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 349 297 | -0,28 | 1 974 | 14,51 | ||||

| 2025-08-13 | 13F | Quadrant Capital Group Llc | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Edmond De Rothschild Holding S.a. | 200 007 | 0,00 | 1 130 | 14,84 | ||||

| 2025-08-29 | NP | WMMAX - Teton Westwood Mighty Mites Fund Class A | 10 000 | 0,00 | 56 | 14,29 | ||||

| 2025-05-15 | 13F | Marshall Wace, Llp | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 81 | 0,00 | 0 | |||||

| 2025-07-24 | NP | FCAJX - Fidelity Climate Action Fund Fidelity Advisor Climate Action Fund: Class A | 6 673 | 0,00 | 36 | 0,00 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Call | 0 | -100,00 | 0 | ||||

| 2025-06-30 | NP | BULD - Pacer BlueStar Engineering the Future ETF | 2 199 | 53,03 | 11 | -8,33 | ||||

| 2025-08-08 | 13F | Candriam Luxembourg S.C.A. | 10 000 | 57 | ||||||

| 2025-07-28 | NP | QQQS - Invesco NASDAQ Future Gen 200 ETF | 8 011 | 31,61 | 43 | 34,38 | ||||

| 2025-08-13 | 13F | Guggenheim Capital Llc | 0 | -100,00 | 0 | |||||

| 2025-08-04 | 13F | AMH Equity Ltd | 207 661 | 88,78 | 1 173 | 116,82 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | C M Bidwell & Associates Ltd | 53 | 0,00 | 0 | |||||

| 2025-08-13 | 13F | Teton Advisors, Inc. | 10 000 | 0,00 | 56 | 14,29 | ||||

| 2025-08-12 | 13F | Pacer Advisors, Inc. | 2 039 | 39,09 | 12 | 57,14 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 4 140 | 0,00 | 23 | 15,00 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 169 583 | 91,04 | 958 | 119,72 | ||||

| 2025-08-13 | 13F | Roubaix Capital, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-30 | 13F | ARK Investment Management LLC | 566 508 | 28,59 | 3 201 | 47,67 | ||||

| 2025-08-14 | 13F | Banque Transatlantique SA | 0 | -100,00 | 0 | |||||

| 2025-07-14 | 13F | GAMMA Investing LLC | 3 693 | 17,20 | 21 | 33,33 | ||||

| 2025-08-14 | 13F | Susquehanna Fundamental Investments, Llc | 33 271 | -38,72 | 188 | -29,96 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | Put | 0 | 0 | |||||

| 2025-08-28 | NP | GWX - SPDR(R) S&P(R) International Small Cap ETF | 17 271 | -1,57 | 98 | 12,79 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | Call | 0 | 0 | |||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Put | 80 300 | 454 | |||||

| 2025-07-29 | NP | FDLS - Inspire Fidelis Multi Factor ETF | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-11 | 13F | Renaissance Group Llc | 236 879 | -11,42 | 1 338 | 1,75 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 19 407 | 27,80 | 110 | 47,30 |